Earners,

Took last week off - so apologies for the delay. Still taking some time off this week as well so I wanted to share one of the first articles I shared as we have a lot of new folks around here! Will have something brand new for you all come Friday.

Very rarely are there magic potions or quick solutions to problems in life that lead to outsized outcomes in your career or with your wealth.

That is absolutely not the case here.

Get the hell out of your own way and start automating everything in your financial life.

Investing is one of those things that the more you do, the worse you do. More clearly, the more tinkering and speculating you do, the more likely you are going to mess up your returns for the long haul. For my finance folks here, you've heard it time and time again - it's next to impossible to try and outperform the stock market. It makes more sense to automate stock market investments and focus all your time and energy on maximizing the hell out of your income by up scaling your career (which I will of course help you with over time with this newsletter). THAT is where the energy is well spent – not finding the next Tesla.

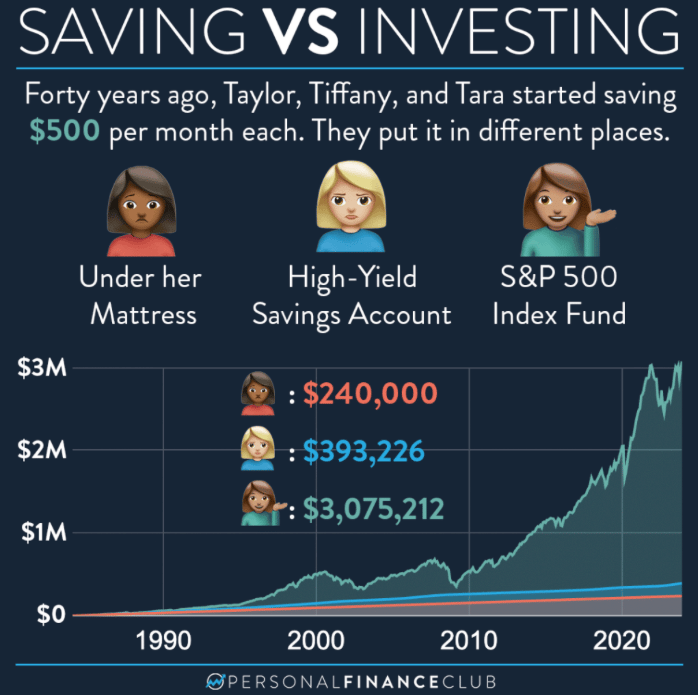

An illustration of the fools errand stock picking by my friend Jeremy at PFC

Automation unlocks everything for you

By automating, you:

Effortlessly save and invest for your future

Your financial goals take no work as they just start to happen based on the levers you set up (i.e., how much you decide to automate to your high-interest accounts, set fixed expenses, set retirement contributions)

Set yourself up for perfect credit as all your bills will always be paid on time in full.

You don't even have to think about your money – it just handles itself and you monitor it like a boss!

This is the BEST way to set up your money. Everything just takes care of itself, so all you have left over is money for some variable expenses and the rest is for guilt-free spending! It's a wonderful way to feel better about your money without putting in extra effort. So next, let's talk about the step-by-step plan you can do to fully automate your money.

Set ‘er up (Dw, very easy)

Step 0: Automate your pay check the right way

The very first point of automation - this is before the money is in your account and is with your employer, so I call it step 0.

So firstly, if you haven't been reviewing your pay stubs, you need to start doing that to ensure that the correct amount has been automatically deposited in your account. I can’t tell you the amount of times that I have heard of someone being over deducted for some reason or another.

Next, if your employer offers a sponsored retirement plan, you NEED to look into this. This is when a company sets up a registered retirement plan that provides you with a source of income during your retirement. Under these plans, you and your employer (or just your employer) regularly contribute money to the plan. When you retire, you'll receive an income from the plan.

Usually, it will be a RPP (Registered Retirement Plan) and/or a RRSP (Registered Retirement Savings Plan) or a 401k for those in the U.S.

These are investment accounts that often times your employer will offer a match to your contribution to the account.

So what does that mean? If the company says they will match up to 5% of your salary, and let's say 5% of your pay check is $50, they will deduct $50 and then put an ADDITIONAL $50 in your account, effectively leaving you with $100 in your account. That's an instant 100% return on your money, plus the compound interest of the investments you selected. My friend, you'll be off to the races.

SUPER big point here: I am willing to bet millions of workers are following the steps above but are not actually investing the capital that they are socking away. It is incredibly important that you are thoughtful about what / if your money is being invested and ensure that it is being put to work ideally in something like a low-cost, broad market index fund or ETF.

Although many will agree that saving for retirement is an excellent financial move, a significant number of employees still do not participate in their employer-sponsored retirement plans. The lack of participation can be the result of not having enough money to make retirement contributions. However, many times, employees don't participate because they're unaware of the benefits and rules of these plans.

So if that is you, take advantage! If you don't have these accounts with your employer, now you’re aware of them to check for them for future jobs.

Step 1: Set up your system

Next, if you don't already have one, create a standard cash cushion in your checking account so that this automation machine doesn't actually hurt you. I'd say anywhere from 1-2 months worth of your expenses is a good idea, but you could do a little more if you'd like. This is not an emergency fund; just the minimum balance that should always be in there so that your account can never go into the negative due to a lack of cash.

Next, pay yourself first. Well – technically you already have paid yourself if you got deducted money from your employer, but you should pay yourself more! All paying yourself first means is automatically setting up deductions for investments and savings. Almost all banks and investment brokerages have an automatic function where you can set up deductions from your main account to go into your savings, which should be a separate account, as well as your investment account(s). Make sure to check in with the specific platform you are using to establish the logistics of it.

How much you choose to save depends on your goals. Try to make this portion at least 20% of your take-home pay then grow it from there. If that sounds like a lot, then start smaller and work your way up. Just pay yourself first! Your future multi-millionaire self will thank you profusely.

Step 2: Automate your debt repayments.

This can be your student loans, mortgage, really any lower interest debt that you need to pay off. Whatever particular debt you are trying to pay off goes here. Select the amounts you wish to pay and go from there.

Some would say that you shouldn't start investing at all until you pay off all your debt. To that, I say – kind of. If it's high-interest rate debt like credit card debt, personal loans – yeah, you should probably throw every penny at that before investing.

Typically, the ground up order should be to establish a small emergency fund, pay off high-interest debt, build up your emergency fund further, then invest while paying off lower interest debt like student loans and mortgage. It’s really up to your circumstances, but I think you should start investing at least a little bit once your high-interest debt is paid off.

Another illustration of the importance of equity investing by Jeremy at PFC

Step 3: Automate every bill you have

Even with the instance of having a provider overcharge you, I wouldn't recommend the cumbersome work of manually paying your bills. People forget things all the time (I know I do) and that’s why this systematic design is so powerful because it protects you from late fees, credit hits and the overall mental baggage of having to remember to pay.

Just like your pay check, however, it is vital to overview your bills to make sure the right amount is being deducted. Setting up alerts on your phone for transactions and reviewing statements periodically as discussed in step 5 is a great way to make sure that the system is running smoothly.

Step 4: Monitor variable expenses

If you work out that you don't have any money left after the first 4 steps, then go back and rework your numbers to fix that because, you know, you still need to live (and not only live but enjoy yourself along the way).

So, assuming a surplus, here is where you flesh out what you would like to allocate to what. Some people don't even do that, though. They just automate literally everything and spend whatever's left over and often times find that there's enough guilt-free money left over that they can just spend freely. If you are able to crush the upfront automations, it will unlock you to guilt free spend your hard earned dollars (because everyone, including your future self, as already been payed!)

For me, I like to have at least some loose parameters around the different buckets in my variable expenses but for the most part, everything is already squared away so I just don’t have to think about it.

Step 5: Set a check in date

The last portion of automating your finances is to periodically review / adjust the amounts that are being deducted for investments, debt payments, etc., based on your goals. Ideally, you want to be increasing your investment contributions and debt repayments as well, if applicable. I suggest reviewing it at least monthly as a gut check to keep in line with your goals.

The key to a sustainable financial plan is the strategic systemization of it. By making everything automatic, it makes your life significantly easier, your financial plans much more effective, and eventually, earns you a lot more money.

Earn more,

Nate