Earners,

One of the most common things that I hear with fellow earners about investing is that they think it’s this really intense, research heavy process.

You need to know all the revenue of the company, the management, the profit margins, EPS… all these terms that make people new to markets TERRIFIED.

What if I told you there was a way to bypass all of that noise and still invest responsibly, while also likely getting the best long term returns possible to grow your hard fought earnings?

Well, there is.

The Key To BIG Wealth

You've probably heard of stocks. Let's use Tesla as an example. If you buy one share of Tesla stock, you own a small part of that company. Now, if something goes wrong and Tesla fails, you could lose a lot if that's all you've invested in. So, it’s wise to invest in multiple companies. But how do you know which ones will succeed and which ones will fail?

Well, you've just stumbled upon a problem that the vast majority of investors still haven't figured out and likely never will.

Stock picking is an incredibly challenging endeavour. Even if you attain some success in the short term, maintaining that performance is laborious, time-consuming, and frustrating. It’s almost certain that you will underperform the market's average return over the long haul.

So, what if I told you that you could beat Wall Street with just 10 minutes of work per year? What if you could build a seven-figure portfolio without being a stock-picking genius?

Enter Index Funds. This is a way for you to own hundreds of companies all at once. If a stock is a fighter jet, then an index fund is like buying the whole fleet. Or, similarly think of Index Funds as a fruit bowl. A stock is like a grape, and an Index Fund is a bowl with many different types of fruit. The benefit is that it takes the guesswork out of figuring out which fruit is best, and you spread your risk across many different types of fruit. So, if one piece of fruit goes bad, you don't care! You still have plenty of fruit in the bowl.

With Index Funds, all you have to worry about is consistently investing over time, and you likely will quickly build wealth. And remember, 99% of people, including big hedge fund Wall Street guys, perform worse than the broad US stock market and many of the ETFs we'll discuss today!

You won't have to switch funds often, as index funds frequently self-cleanse, adding better performing companies over time and removing the losers.

For instance, the S&P 500 is a collection of 500 of the largest companies in the US. There is turnover to maintain the top 500 companies in the mix. Things like profitability, market cap etc. So, you don't have to worry about stock picking. You just have to stay consistent, and you will win in the market in the long term.

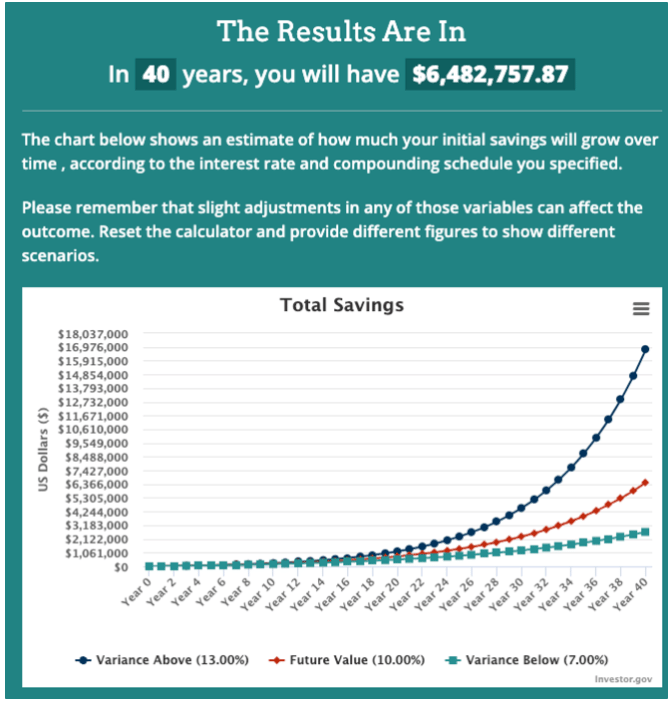

Below is an example of what you’d have investing in the S&P 500 investing $1000 / month from age 25-65, with a 3% variance up or down (aka if you returned 3% more or less than the historical average). Here’s the link to the calculator:

Hypothetical 40 Year Returns Investing In The US Market

What I Invest In

ETFs, or Exchange-Traded Funds, are what I invest in to access the market. I don't necessarily prefer them, but in Canada, it's much easier to buy ETFs than Index Funds. They are very similar with just a few differences. While Index Funds are more static, ETFs are traded in a market like a stock. However, they're so similar that the returns are virtually the same if the specific Index Fund or ETF is invested in the same things. In the US, you can invest in either, but for this guide, we'll focus on ETFs as the experience is likely similar in other countries.

Broad market ETFs that invest in American companies, which represent the entire stock market, have proven to be one of the most effective and wise wealth builders long-term worldwide. Buying a broad-based ETF is like buying a slice of the entire stock market pie, with all its different components.

Where should you buy ETF’s? And which ones should you buy?

Step 1: Begin by researching and learning about ETFs to determine which ones you wish to invest in. Some of my favourites are ETFs that track the S&P 500 or the Total US Stock Market, as well as broader international markets. You can also quickly research the thousands of different ETFs available with a Google search of "ETF Your Country." While the specifics may vary by country, what they track remains consistent if that’s their stated strategy (i.e “this ETF seeks to track the US market or emerging markets, international” etc). I would definitely recommend embarking on some in-depth research for yourself!

Step 2: Decide which platform you want to use. Nowadays, it's easier than ever to buy ETFs with various low- or no-fee platforms available. All you need to do is set up an account, purchase some ETFs, and you'll quickly become an investor. You can find the best platform for you by Googling "best low-cost brokerages in my country." Look for a platform that offers affordable options, an easy-to-use interface, registered accounts like Roth IRAs or TFSAs, and has excellent reviews. In Canada, I use Questrade and Wealthsimple Trade, and in the US, platforms like E-Trade, Charles Schwab, Fidelity, and TD Ameritrade are popular choices. The main goal is to start investing as soon as possible without breaking the bank.

Step 3: Determine the type of account you want to open. In the US, a Roth IRA is a good starting point (assuming you're already contributing to your work 401k, or employer RRSP if you have one). In Canada, a TFSA is a great option for beginners. As you gain more experience, you can explore other account options.

Step 4: Once you've chosen your platform, the type of account you want to open, and the ETFs you want to buy, the next step is to open an account. Keep in mind that the process may vary slightly depending on the platform, but it generally involves providing certain information.

Step 5: After opening your account, you'll likely be able to link your bank account to fund it. Allow a few business days for the money to be transferred into your account.

Step 6: Once the funds are in your account, it's time to make your purchase! This process may also vary slightly depending on the platform, but it's generally quite straightforward. You’ll look up the specific ticker of the ETF you’d like to buy and execute what’s called a trade (you give them money, they give you the ETF).

Congratulations! You're now an investor!

To recap:

Step 1: Research ETFs

Step 2: Choose a platform

Step 3: Decide on an account type

Step 4: Open the account

Step 5: Fund the account

Step 6: Buy the ETF

There you go - a little guide for you to come back to if you haven’t started the journey yet!

Earn more,

Nate

As always folks, I am not an investment advisor and none of this is financial advice. All of this is for educational purposes only and the reason I am mentioning specific ETFs is simply for example purposes and is NOT recommendation from me to buy them. Please do your own research and invest your hard earned dollars at your own risk!