Earners,

Some of us have great bosses. Some of us, not so great. And some…have bosses to whom we would LOVE to yell something that rhymes with ‘Puck Shoe”.

Fortunately, if you make some smart moves throughout your career, you’ll reach a status where you are work optional. You no longer need to work, but choose to out of fulfillment or some other personal reason. It's not so much about the money anymore, meaning your superiors have much less leverage over you. If they tested you, you could let them know who the real boss is.

A wonderful thought indeed - but how do we get there? Let’s take a look at how we can think about those numbers.

The 4% Rule

So you may read the above and think that “oh, Nate's talking about the FIRE movement here”. I mentioned the FIRE movement in the last issue, and how some people do FAT FIRE, meaning they want to make a lot of money and ride off into the sunset.

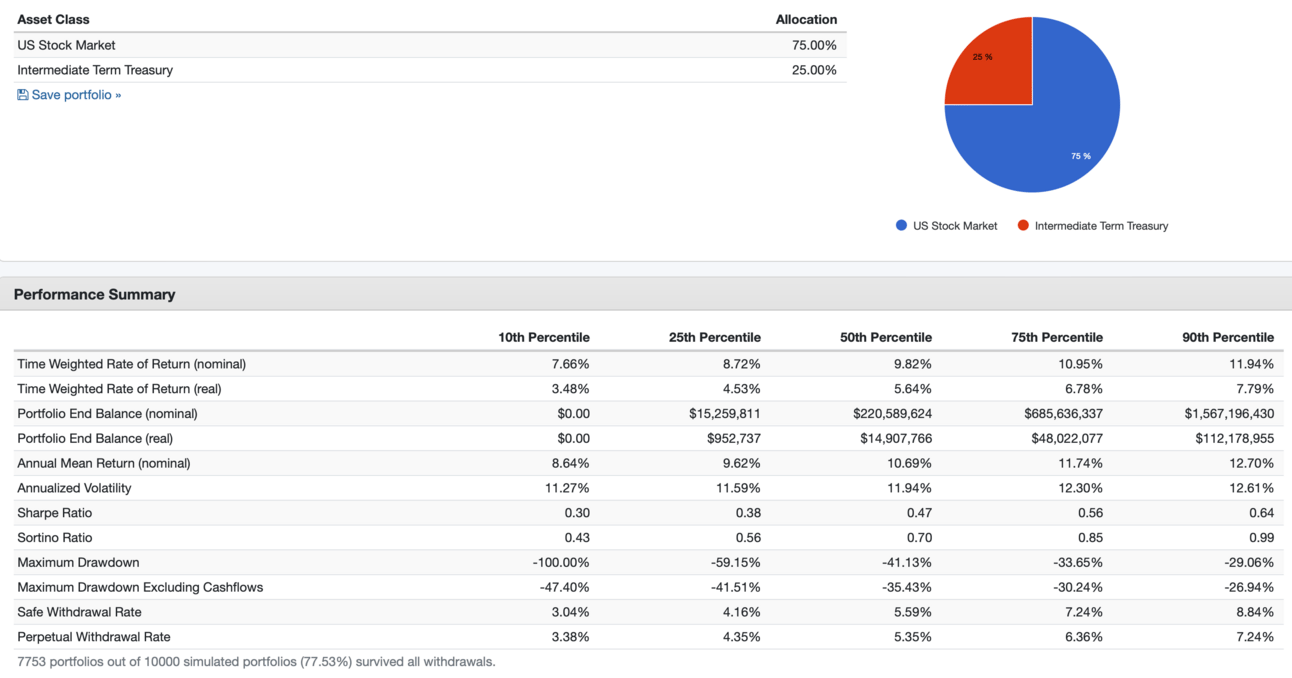

The basic premise is that you save a ridiculously high portion of your income (50%+) and do that until you have 25x your annual spending invested. So let’s say you spend $50,000 a year - you would theoretically need $1,250,000 invested to FIRE. You would then withdraw 4% of your portfolio a year (i.e $50k), and the thought is if you’re able to average at or over a 4% return per year, (which is a quite low bar) you’ll indefinitely have a pool of money to draw from. There are these calculations called “Monte Carlo Simulations” where you can run to see a given portfolio's likelihood of running out, or if it ever will based on historical data. You can run some numbers with the link below and also below is a quick example of if you FIRE at 35 with the above example over 70 years with a 75% stock/ 25% bond portfolio:

Example portfolio simulation 75 equity / 25 bond over 70 years

So, that's the concept of FIRE. Accumulate a bag of money and grow it to live off of.

Don't Believe In Retiring Early

I lean more towards the financial independence mindset than the retire early one. I genuinely don't think that many people who achieve FIRE actually “retire early”. Many of them have side businesses, continue to work or pursue some financial endeavour of their choice.

To me, a life spent always travelling, doing activities and never working seems pretty dull. I know, it sounds insane of me to say - but trust me. With modern medicine, if you FIRE at let's say 35 years old, you could have another 70 years like the portfolio above… You're telling me you're not going to work at all and live off your portfolio for 70 years? I mean, as we saw, it's unlikely the money would run out - but man, that just seems so boring to me!

The type of people who would be totally fine not working for 70 years are probably not the type who could FIRE as early as you could. Work can be fulfilling now. You can build and develop things you care about, run organizations for your community, become a public servant, etc. There's too much beautiful, awesome stuff for someone as capable as you to just sit around all day after you've achieved such a monumental feat. I think a more realistic approach is to work feverishly towards financial independence and then impact the world around us in a significant way. And then take 6 months off in the south of France or Fiji here and there. I didn't say you needed to work ALL the time…

I also believe in finding joy in life while saving money. If saving a large amount of money makes you unhappy, then reduce it until you can save a reasonable portion and still enjoy yourself. Many people are surprised to discover that their happiness remains constant even if they don't spend every last dollar they have. I don't think you'll be any less "happy" by going from no savings to saving 15-20%. Each person needs to find the goldilocks amount for themselves. High earners who are naturally frugal/minimalist have an easier time with this. They don't desire much and have a high disposable income, so their savings rate ends up being ridiculous.

What's Your Number?

Let's say you're 22 and you graduate into a pretty solid job where you make $70k a year. Let's say you're also able to live quite frugally and save 60% of your pre-tax income. And before you say it…yes, this is not "realistic" for most people just graduating, but what I am explaining is quite extreme. This savings rate would allow you to invest $3500 / month in the US market at a historical average return of 9.8%. To level off this assumption, we will keep your income constant throughout the years (which as we know, should NOT be the case and should ideally be increasing).

If you were to pull this off, you'd have your first million by 35 and by 37 would be financially independent at $1.38 million assuming you're spending $50,000 per year or below. There’s also a variance in the graph to show if your returns are better or worse than you think.

Example projection $3500/month at 9.8% over 40 years

I would say for most people, having over a million dollars invested under the age of 40 gives them a TON of leverage over what they do and how they do it. Maybe you don't even touch your portfolio and just want to let it grow (which isn't the worst idea in the world). However, having that amount in net worth virtually liquid is one hell of a card to have in your back pocket. Having that much that young means it has decades more to compound. Assuming you just continue to invest nice and boring, an 8 figure net worth is around the corner.

But $50k / year is not enough money for what I want…

Same! It’s a simple example, and what you want can be adjusted to your specific plan. I also think we don't necessarily need to be in an INSANE rush to hit our FU number. We may have a lower savings rate, but we enjoy life more along the way. Totally not opposed to that. The best way we can achieve both an early FU number and fun along the way is to sustainably grow our earnings over time. With more earnings, we can invest more. Whether that's into the market, real estate, or into our side businesses that we could maybe go full time with someday.

In my personal opinion, I think a solid number to shoot for is $4,000,000. That puts you at a $160,000 withdrawal per year (whether you end up actually drawing on it or not), which to me is more than enough to spend a year to live a pretty rich life but isn't such an insane number that it's impossible to get there. In our FIRE example above, you'd hit $4MM at 46. However, again, that assumes your earnings don't grow at ALL and you invest a fixed amount. If you focus your energy on leveling up your income into and past the six-figure mark and you're able to increase how much money you're dumping in the market, you'll get there faster. A lot faster. However, we all are likely different ages than the one in the example, but that doesn’t mean it is impossible for you to achieve FU status. If you want to play around with what you think your number could be, you can check out the calculator below.

Do you vibe with the FIRE movement? Do you have a number in mind? I'd love to know so please reply and let's have a chat! Also, for those that noticed, we missed the Friday issue - so it is coming out now so we can get back on schedule. Travelling was a factor BUT this is the last time I try to make that excuse. We are on it now and I will keep pumping these out!

Earn more,

Nate