Earners,

You can become a multimillionaire working a regular 9-5 job. No question. But I usually talk about how you can do that investing on into indexed products like ETFs and Index Funds — but we are going to talk about a slightly different angle. You don't have to be an entrepreneur, risk your savings in speculative investments, or invent the next tech revolution. A very viable way is to leverage mid-to-late stage startups. Here's how to capitalize, baby:

The Sweet Spot

When we talk about wealth-building at a startup, we're not looking at early-stage companies with just an idea and a few employees. We're talking about companies with 1,000+ employees, substantial funding, and proven products. These companies are well past the high-risk phase, but they still have enough room to grow significantly, giving you a legitimate opportunity for a big-time payday.

Look at companies like Slack, Airbnb, and Zoom. People who joined these companies when they were at the mid-to-late stage (around 1,000 employees) and received stock options or RSUs (Restricted Stock Units) didn't just make hundreds of thousands—they made millions upon millions.

One of my best friends also joined a company as a middle manager back in 2019. By 2022, they had gone through two funding rounds, and the valuation put his stock at over a million on paper in just 3 years. It's certainly possible to get there even without the crazy examples.

Case Study: Zoom IPO

If you joined Zoom in 2017, when they had around 1,000 employees and received stock options worth $250,000 (a typical mid-stage package), by the time of their IPO in 2019, Zoom's stock price surged over 7x. That $250,000 in stock could have turned into $1.75 million or more within just a couple of years. And if you held onto those shares as the company continued to grow post-IPO, your stake could be worth even more today.

This is what we're talking about when we say mid-to-late stage: The company's growth potential is still enormous, but the risk is considerably lower than early-stage ventures. It's the perfect blend of high reward with lower risk.

The Math Behind Stock Packages

Here's where most people miss out: stock packages are your ticket to wealth when you join a company at this stage. Yes, salary is important, but stock? That's where the real money is.

Let's break it down. Say you join a company with 1,000 employees that has raised $500 million in funding. You get a compensation package that includes:

$150,000 annual salary

$50,000 annual bonus

$300,000 in stock options over four years

At first glance, the salary and bonus seem like the biggest part of your compensation, right? Wrong.

If the company doubles or even triples in value over the next five years (which is entirely possible for a startup in this stage of growth), that $300,000 stock grant could easily become $600,000 to $900,000—and that's before any major IPO or acquisition. If the company 10x's its value, that same stock could be worth $3 million or more.

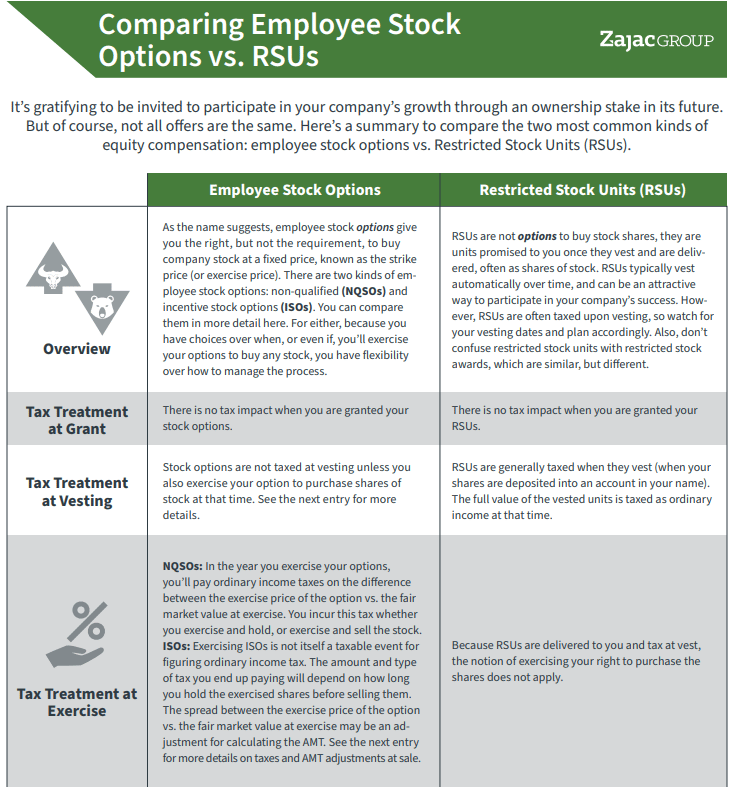

Tip #1: Ask About Equity When negotiating a job offer, ask for details about stock options or RSUs. Don't settle for a basic offer. Push for more equity, and ask about the company's growth trajectory to gauge the potential upside.

What Are the Chances?

"But not every company will go 10x!" you might think. And you're right. But here's the deal: not every company has to go 10x for you to build significant wealth. A 2x or 3x growth can still make a massive difference.

Even if the company only doubles in value, you're still looking at a 6-figure boost to your net worth. The point is, you don't need to chase unicorns; you need to get in when the company has significant growth potential left.

Focus on the Right Companies

Not all startups are created equal, and picking the right one to join is key. You want companies that are:

Profitable or close to it – Look at their financials, their revenue, and how fast they're growing.

Funded by reputable investors – Companies with solid backing from VC firms like Andreessen Horowitz, Sequoia, or Accel are more likely to succeed.

In a high-growth industry – Sectors like fintech, SaaS, and healthcare tech are exploding right now.

A good idea could be to target companies that have already raised $50 million+ in funding and yet have strong economics (and not stupid valuations). They've proven themselves but still have plenty of room to scale. When you join a company like this, the upside can be enormous, and the risk of collapse is lower than in early-stage startups.

The Myth of Entrepreneurship

We've been sold a myth that you need to be a founder or work at the ground floor of a startup to get rich. But the truth is, for every founder that succeeds, there are hundreds of employees who made millions quietly, just by working their 9-5, negotiating a great stock package, and riding the wave of growth.

You don't need to grind 16-hour days and build your own company to generate serious wealth. You can do it while working a normal schedule and still have your evenings and weekends free.

Fact: Startup Millionaires

A report by Carta found that in 2019, over $1 trillion in equity was distributed to startup employees through stock options and RSUs. These aren't founders or early investors; these are regular employees who joined at the right time.

Timing is Everything

If you're already in your career or looking to switch jobs, the timing to join a startup is crucial. The best time to join is when they're on the cusp of massive growth but have already proven their business model.

This is usually when they've reached 500 to 1,500 employees and have raised multiple rounds of funding. A company that's raised a Series C or D round and has $500 million to $1 billion in valuation is a prime target.

The earlier you can join in this stage, the more stock options you'll likely receive, and the higher the upside if the company goes public or gets acquired. This is when employees often see their stock value 2x, 5x, or even 10x over a few years.

Tip #2: Vesting Schedules Pay attention to the vesting schedule of your stock options or RSUs. Most companies have a 4-year vesting period with a 1-year cliff. This means that after one year, 25% of your stock will vest, and the remaining 75% will vest monthly over the next three years.

The Bottom Line

You don't need to take enormous risks or work for 30 years to build serious wealth. By being strategic about where you work—choosing mid-to-late stage startups and negotiating for solid stock packages—you can put yourself on the path to becoming a multimillionaire while working a regular 9-5 job.

The next time you're thinking about your career path, consider this: it's not just the paycheck you're chasing; it's the potential for equity. And that equity, if positioned correctly, can be your ticket to financial freedom.

Earn more,

Nate