Earners,

You're tired. I know. You grind every day, and every dollar you make is hard-earned. But here’s the thing—all that effort means nothing if you don’t put your money to work. We can talk all day about maximizing your income, but if you don’t invest, it’s like running on a treadmill—you’re expending energy but getting nowhere.

Let’s talk about investing, a word that often comes with baggage. People think it’s complex, full of jargon, and requires a deep dive into company financials—revenue, management teams, profit margins, earnings per share. It's easy to see why the thought of investing can be intimidating.

But what if there was a way to bypass all that noise? What if you could invest wisely, with a clear path toward growing your hard-earned money, without getting lost in the weeds? There is. And it’s simpler than you think.

The Key to Wealth: Keep It Simple

You’ve heard of stocks. Let’s use Tesla as an example. When you buy Tesla stock, you own a piece of the company. But if Tesla stumbles, and it's your only investment, you could lose a lot. That’s why diversification—spreading your investment across multiple companies—is crucial. But how do you know which companies will thrive and which will falter?

Here’s the reality—most people, even the so-called experts, never fully crack that code. Stock picking is hard. Sure, you might hit a few home runs early on, but over time, the market has a way of humbling even the savviest investors. The data doesn’t lie—most active traders underperform the market in the long run.

So, what’s the alternative? How do you outpace Wall Street with just 10 minutes of work a year? How do you build a seven-figure portfolio without a crystal ball?

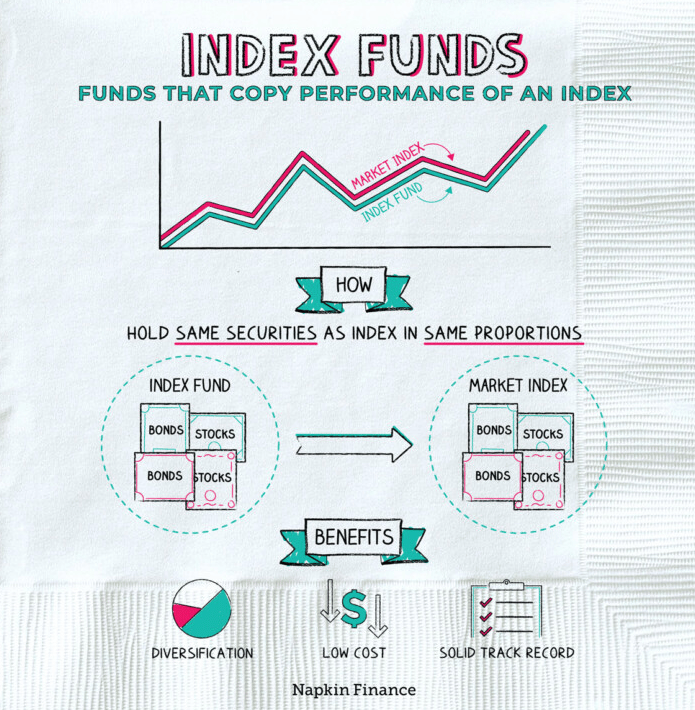

The answer is simple: Index Funds and ETFs.

Why ETFs and Index Funds Are Your Best Bet

ETFs (Exchange-Traded Funds) and Index Funds allow you to own hundreds of companies at once. Think of a single stock as a grape. Buying an ETF or Index Fund is like buying a fruit bowl filled with all kinds of fruit. If one piece goes bad, you still have a healthy variety left. It’s about spreading risk and simplifying your investment strategy.

The beauty of ETFs and Index Funds is that they do the heavy lifting for you. They’re designed to match the market’s performance, which means you don’t have to worry about picking the next big winner. Just keep investing consistently, and over time, you’re likely to see substantial growth.

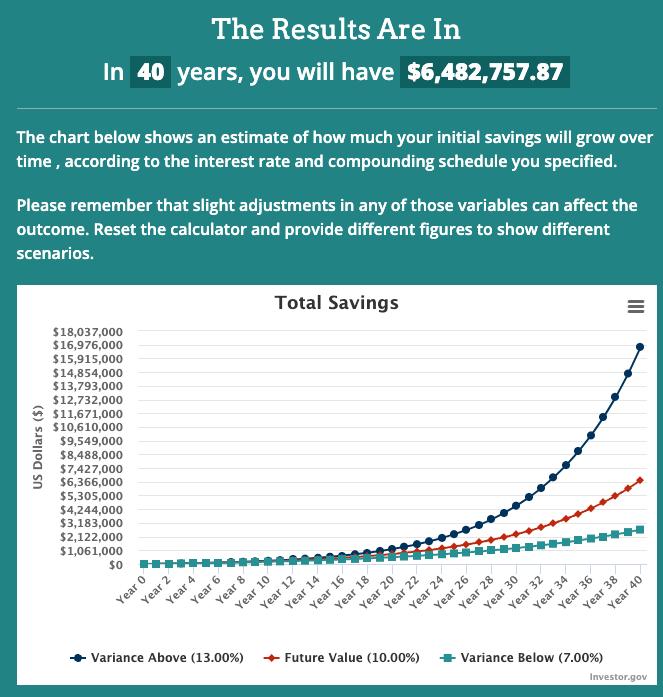

Below is an example of what you’d have investing in the S&P 500 investing $1000 / month from age 25-65, with a 3% variance up or down (aka if you returned 3% more or less than the historical average). Here’s the link to the calculator:

Hypothetical growth of above example in the US Market

Why ETFs Work—Especially in Canada

In Canada, ETFs are often easier to buy than Index Funds. They trade like stocks, giving you flexibility, but they deliver similar returns to Index Funds if they track the same assets. Whether you’re in Canada, the U.S., or elsewhere, the principles are the same: broad exposure to the market, low costs, and long-term growth potential.

For Canadian investors, BMO offers some excellent ETF options. The BMO S&P 500 Index ETF (ZSP) is a favourite—it tracks the S&P 500, giving you a stake in 500 of the largest companies in the U.S. The S&P 500 is regularly updated, removing underperformers and adding strong contenders, so you don’t have to worry about constant rebalancing. Just invest and let time do the work.

Another solid choice is the BMO MSCI All Country World Index ETF (ZAC). This ETF provides global exposure, investing in large and mid-cap stocks across developed and emerging markets. It’s a straightforward way to diversify beyond North America and tap into the growth potential of companies worldwide.

If you’re more focused on the Canadian market, the BMO S&P/TSX Capped Composite Index ETF (ZCN) gives you exposure to the largest companies on the Toronto Stock Exchange. And for those who want a mix of growth and income, the BMO Canadian Dividend ETF (ZDV) is a wise pick, focusing on high-quality Canadian companies with a history of paying dividends.

Investing in the U.S. – Fidelity Index Funds and Vanguard ETFs

For my American readers, let’s talk about two key players: Fidelity and Vanguard. Both offer fantastic options for long-term investing.

Fidelity’s index funds are a great starting point, with low fees and broad market exposure. Take the Fidelity 500 Index Fund (FXAIX), which tracks the S&P 500. It's similar to BMO’s ZSP but tailored for U.S. investors. It’s simple, effective, and time-tested.

On the ETF side, Vanguard is a leader. The Vanguard Total Stock Market ETF (VTI) offers exposure to the entire U.S. stock market, from large-cap to small-cap companies. If you want international exposure, the Vanguard Total International Stock ETF (VXUS) covers both developed and emerging markets outside the U.S.

Consistent investment in these funds can build a diversified portfolio that captures growth from various sectors and regions, all while keeping costs low. Whether you’re more comfortable with Fidelity’s index funds or prefer the flexibility of Vanguard ETFs, both options are designed for long-term success.

Getting Started with ETFs: A Step-by-Step Guide

So, how do you start? Where do you buy ETFs, and which ones should you choose?

Step 1: Research ETFs Start by looking into ETFs that align with your investment goals. Whether it's the BMO S&P 500 ZSP or Vanguard’s VTI, take your time to understand your options. This isn’t about getting rich quick—it’s about smart, steady growth.

Step 2: Choose a Platform Thanks to technology, buying ETFs is easier than ever. Look for low- or no-fee platforms. In Canada, Questrade and Wealthsimple Trade are popular choices. In the U.S., consider platforms like E-Trade, Charles Schwab, Fidelity, or TD Ameritrade. You want a platform that’s easy to use and cost-effective.

Step 3: Decide on an Account Type Start with a tax-advantaged account. In Canada, that’s likely a TFSA; in the U.S., consider a Roth IRA. These accounts help your money grow faster by shielding it from taxes.

Step 4: Open the Account Opening an account is straightforward. You’ll need some personal information and financial details, but most platforms guide you through the process step by step.

Step 5: Fund Your Account Link your bank account and transfer funds. It might take a few days, but once the money’s in, you’re ready to invest.

Step 6: Buy the ETF Now, the exciting part. Look up the ticker symbol—whether it’s BMO's ZSP, Vanguard’s VTI, or another ETF of your choice—and make your purchase. Congratulations, you’re now an investor.

To Recap:

Research Index Funds/ETFs

Choose a Platform

Decide on an Account Type

Open the Account

Fund the Account

Buy the ETF

Watch your wealth grow.

Investing doesn’t have to be a convoluted mess. Stick to a process, and things will start to click. You’ll see those millions on the horizon, and with discipline, they’ll become your reality.

But remember, this isn’t financial advice—it’s an educational guide to get you moving. The goal is to help you start putting your money to work. Now get to it.

Earn more,

Nate

As always folks, I am not an investment advisor and none of this is financial advice. All of this is for educational purposes only and the reason I am mentioning specific ETFs is simply for example purposes and is NOT recommendation from me to buy them. Please do your own research and invest your hard earned dollars at your own risk!